With the current economic

situations, credit card companies are using big data analytics now more than

ever. If you have ever wondered how you can either get approved or disapproved for

a credit card within a few minutes if not seconds based on just a few numbers

input by you then this blog is for you. Credit card companies have collected

years of data and have set up certain predictive metrics to figure out if the

person applying for a credit card should be approved or not. I found a great

program for this type of analysis called BigML. This is another free program

that is incredibly powerful.

In order to use BigML you must

first create a username and password. You will receive an email with a

confirmation link once you have input your information. Then click on the

confirmation link in your email and you are ready to start working with this

amazing product. It has a few datasets already listed for you to learn with and

one of those is, “Credit Application’s dataset.” I used that data to set up

diagrams and a prediction sheet.

Once you have input the data

your screen will change to a breakdown screen of the different categories

within the dataset provided. This is represented in figure 1 below. After you

are on that screen you can click on view dataset and it will change to show miniature

graphs of each category on the right side of the screen. This is shown in

Figure 2 below.

Figure

1: Data Category Breakdown

Figure

2: Display of Miniature Category Graphs

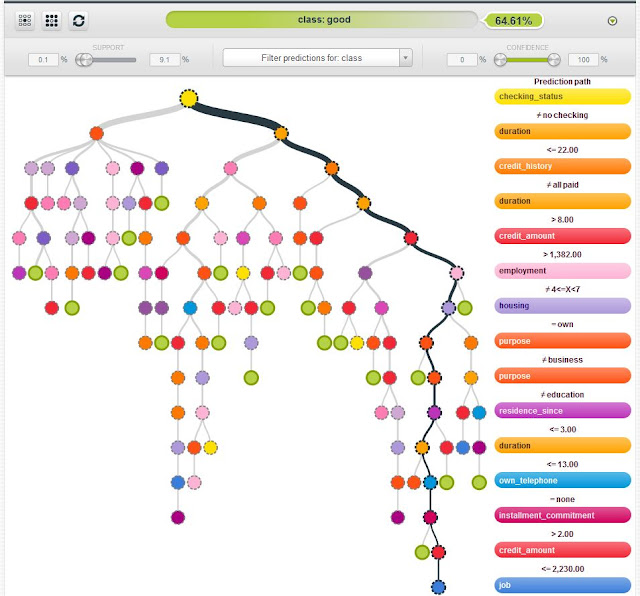

Once you are done with that feature

you can click on the Models tab at the top. This will take you to a new screen

where you will need to click on the model you wish to look at. In my opinion

this is the best part of the program because it gives you an overall view of

how each path can be traced to see which people would be approved or denied.

This could be useful to anyone thinking about getting a credit card because they

could look at the branch that they fit in and have a good idea if they would be

approved for a credit card. Figure 3 below shows what this looks like with a

good path of 64.61% confidence based on the answers provided on the right side

of the screen. Figure 4 shows a representation of a bad applicant with a 52.30%

confidence based on the information on the right of the screen.

Figure 3: Good Applicant

Figure 4: Bad Applicant

Once you are done looking at

this portion of the program you can click on the predictions section of the

program. This section is probably the most useful for the credit card company

because you input the applicant’s information and it will tell you if this

applicant is a good or bad person for credit approval. This allows for quick

approval for retail credit cards. Figure 5 below shows the prediction screen

and some of the input sections.

Figure 5: Prediction Screen

If you are interested in trying out this program please go to:

Couldn't find the dataset so I could closely follow, but your tute was very helpful nonetheless.

ReplyDeleteThanks